Gift Aid is an invaluable resource for charities, enabling them to boost their income by claiming an extra 25% on donations from UK taxpayers. However, navigating the Gift Aid process can often be complex and time-consuming. Kudos Software offers a streamlined approach that makes the sign up process quicker, easier, more secure, and more accurate for both donors and volunteers. In this blog, we explore how software like Kudos’ Retail Gift Aid technology, can help charity shops maximise Retail Gift Aid income, increase repeat donations, and build relationships with supporters.

Key Takeaways

- How Retail Gift Aid works

- Benefits for charities

- The Retail Gift Aid Process

- Tax implications

- Maximising Retail Gift Aid income

- Optimising sales and pricing for better returns

- Harnessing technology

- Building stronger supporter relationships

How Retail Gift Aid Works

Retail Gift Aid is a government scheme that allows UK charities to claim an additional 25% on the sale price of donated goods sold on behalf of UK taxpayers in charity shops and online from HMRC. This boosts the value of the donations, enabling charities to maximise the impact of donated items and raise more funds for their important causes.

Benefits for Charities

Charity shops have the opportunity to take advantage of the Retail Gift Aid scheme, which allows them to enhance the value of the donations they receive. By participating in this scheme, charity shops can claim an additional 25% on top of the sale price of donated goods, provided the donor is a UK taxpayer.

To successfully implement this scheme, charity shops must follow the guidelines set by His Majesty’s Revenue and Customs (HMRC). These guidelines ensure that the process is transparent and compliant with tax regulations. It involves obtaining consent from the donor, tracking sales, and maintaining accurate records to support any claims.

By following HMRC’s guidance on Retail Gift Aid, charity shops can efficiently claim Gift Aid on the donations they receive. This not only maximises the potential revenue from donations but also contributes to the overall mission of the charity by providing additional income to support their objectives.

The Retail Gift Aid Process

When supporters donate items to a charity shop, charities need to check whether or not the donor is a UK taxpayer. If so, and the donor is not already registered with the charity for Retail Gift Aid, then the instore charity shop team can ask the donor to sign-up. This means that the donor agrees that the charity can reclaim 25% of the sale price of those donated items from HMRC.

Retail Gift Aid is open to UK taxpayers who have paid sufficient income tax or capital gains tax to cover the amount of Gift Aid claimed in that tax year. The additional 25% is claimed from HMRC, and the donor can opt out of Gift Aid at any time.

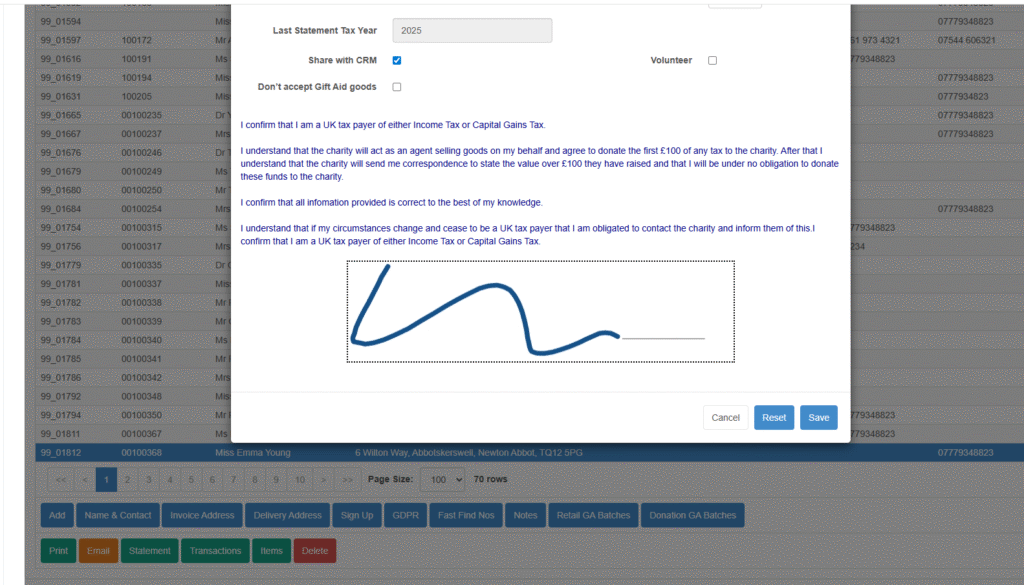

A Gift Aid declaration form is required to claim Retail Gift Aid on donations. The form must include the donor’s name and home address and can be paper or digital but personal details must be processed and held securely, in line with the Data Protection Act and UK GDPR guidelines.

Tax Implications

Donors (but not charities) may be liable for Capital Gains Tax on the sale of donated goods. Whereas charities may be liable for Corporation Tax on the sale of donated goods. Both parties should follow HMRC’s guidance, or seek professional advice, where necessary.

Donors should notify the charity if their circumstances change and they no longer pay tax. Charities should update their records and stop claiming Gift Aid on donations from donors who no longer pay tax. The Kudos charity card app can be used to keep donor details up to date.

Maximising Retail Gift Aid Income with Ease

One of the key features of Kudos, is its ability to integrate simply and seamlessly with your charity’s retail operation. The software allows charities to sign up new donors either in-store at the point of sale, on your charity’s website, or by using our dedicated Signup app, ensuring secure and accurate donor records.

Optimising Sales and Pricing for Better Returns

Achieving the highest possible selling price for donated items is crucial for maximising Gift Aid earnings. Kudos offers the flexibility needed to implement a pricing strategy that aligns with your charity’s goals, whether through standardised pricing, customisable categories, or giving autonomy to individual shops. By empowering your team with the right tools, Kudos ensures that every donated item is sold at its best price, thereby boosting potential Gift Aid returns.

Harnessing Retail Technology

Kudos goes beyond just simplifying the sign-up process; it eliminates the need for cumbersome paper forms, offering peace of mind that donor data is stored securely. With tools that support both Standard Method and Method A or Method B, the sign-up and claims process becomes not only swift but also simple, allowing charities to manage Gift Aid and remain in control of their claim frequency while streamlining operations and building strong relationships with Gift Aid donors. The business intelligence gives managers all the information they need to make data driven decisions about sales, Gift Aid, and more.

Streamlining Retail Gift Aid Tracking with Barcoding

The integration of barcoding technology into the Gift Aid process simplifies tracking by embedding the donor ID, stock category, and price into a single scan barcode. Barcoding donated items that are eligible for Retail Gift Aid, is a simple way to ensure that the donated item, and subsequent Gift Aid, is captured at the point of sale. By embedding the GA donor ID, stock category and price into a single scan barcode, volunteers can process sales quickly and happily.

The simplicity of Kudos Gift Aid software means that as items are scanned at the point of sale, the Gift Aid records are quickly updated and securely held ready for processing, with minimal admin or paperwork. This feature not only ensures that gift aid donations are accurately captured at the point of sale, but also frees up volunteers to focus on providing excellent customer service. Moreover, electronic sign-ups reduce errors and help to convert more donors into regular Gift Aid supporters.

Building Stronger Supporter Relationships

Kudos doesn’t just improve processes for your team; the technology also enhances donor relationships by automating thank-you emails, and the Charity Card supporter app is a great way to encourage Gift Aid donations and communicate with supporters. This builds a sense of community and loyalty, encouraging repeat donations and ongoing support. With Kudos, donors can also easily contribute through various methods, such as donating spare change, or paying in cash donations/money raised from fundraising events for charitable purposes at the till.

Conclusion

Retail Gift Aid offers a valuable opportunity for charities to enhance their income generation efforts through charity shops. Kudos Software combines technological innovation with practical solutions to maximise Gift Aid revenue with minimal effort.

Proper setup and adherence to HMRC’s guidelines are crucial for maximising the benefits of the Retail Gift Aid scheme. By simplifying Retail Gift Aid processes, ensuring data accuracy, and engaging donors effectively, retail gift aid technology empowers charities to achieve their objectives while maintaining strong donor relationships.